The Biopharma Report #013

Important Update, Novartis One Step Closer To Its Pluvicto Blockbuster Aspirations

Welcome to a new issue of The Biopharma Report!

Hello everyone, before we dive-in I just want to give a quick update. As you might have noticed, I started publishing more regularly and hopefully will keep it up. The last email I sent had a paywall where it wasn’t supposed to be (I have been experimenting with the feature for a few days) – so I apologize for that! I am republishing it here without the paywall. For those of you who had purchased a subscription to read the article, a refund has been issued (it should take 5-10 business days) as mentioned in my previous email.

I have been publishing for a while now, and I have been receiving questions about what I write and about unrelated companies/topics – mostly from hedge funds as well as venture capital funds and private equity firms. Given that I am receiving a lot of questions - and that I have been doing expert calls on different networks for a while now – I think it would be interesting to host weekly (or more frequently depending on volume) Q&A sessions about anything pharma/biotech (I can also discuss medtech, diagnostics, and life sciences companies to a degree). So, I am excited to announce that I am rolling out a new premium subscription tier for those who are interested in Q&As. You can ask me any questions (anonymously if you want) on this form and I will try to answer all questions in the weekly Q&A email. If you are reluctant to get a premium subscription to have access to the Q&A emails, you can always sign up for a free trial. I hope this is something that will bring value to your research!

Novartis Announces Positive Pluvicto Data

Novartis is one step closer to its $2B sales aspirations for its radioligand rising star Pluvicto.

Pluvicto is currently approved in patients with PSMA-positive metastatic castration-resistant prostate cancer (mCRPC) that have undergone taxane-based chemo. The pre-taxane market is 3-4 times the size of Pluvicto’s current market - so this week’s data is making management and investors very happy. We only have topline data for now but everything seems solid. Novartis is eyeing an FDA submission next year - which signals confidence in the data.

Novartis’ $2B sales forecast for Pluvicto also encompasses the metastatic hormone-sensitive prostate cancer market. Data from the pivotal trial in this indication is due to drop next year.

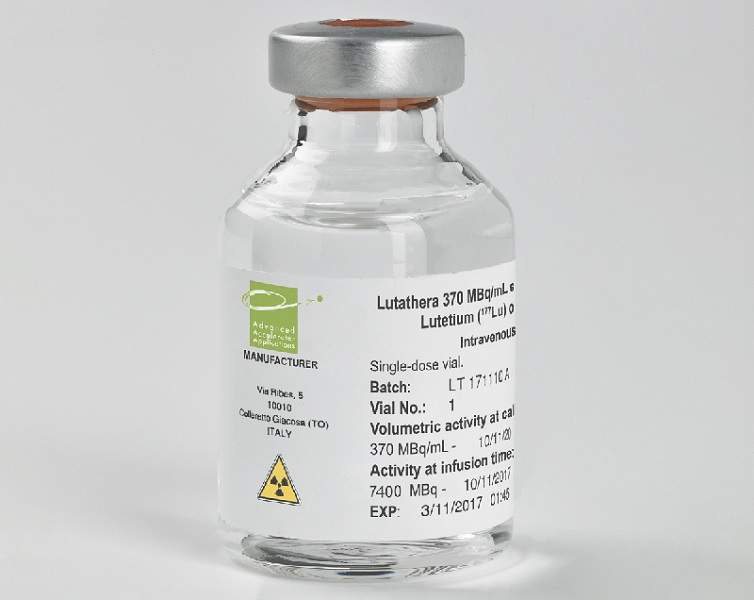

One problem with Pluvicto has been supply chain disruptions. Earlier this year, Novartis had to halt manufacturing in two of its radioligand therapy facilities - one in the US and one in Italy. The supply of both Pluvicto as well as Novartis’ gastroenteropancreatic neuroendocrine cancer drug Lutathera were impacted by the suspension. Now, it is important to note that the issues that led to the production halt in both facilities were independent. In the US plant, routine testing wasn’t done properly - which is what led to the halt. But interestingly enough, this wasn’t the first time that the US plant came under scrutiny.

In 2018, the FDA flagged several issues in the facility that could impact the quality of drugs. In 2021, an FDA inspection found that cleaning and record-keeping procedures were not up to standards and issued Novartis a warning. Now, Novartis denies that the 2021 warning and the May 2022 suspension are linked - but these instances are possibly symptoms of a bigger problem in this facility. That being said, less details are known about the Italy plant.

Manufacturing hiccups happen all the time, and radioligand therapy is relatively new - but given the importance of Pluvicto and radioligand therapy in terms of Novartis’ strategy, the company should have probably adopted a more proactive approach - and by that I mean hiring more people with backgrounds in radiopharmaceuticals.

Now, in all honesty, the FDA does tend to overreact, but Novartis should never jeopardize in any way the continuity of its potential blockbuster and Lutathera - especially given that they were being used in trials. I did find that Novartis handled the suspension well: the matter was resolved in a couple of months, and corrective action was taken in both plants.

In a way, Novartis was “lucky” that the hiccup occurred before the launch of Pluvicto in the pre-taxane indication - if it had happened during or even after, the commercial impact would have been in a different order of magnitude. I believe that the ordeal made Novartis more ready than ever to redefine the radiopharmaceuticals market and significantly contributed to the company’s learning curve in terms of radioligand therapy manufacturing.

Novartis has been beefing up the production capacity in both the US and Italy facilities to accommodate the potential increase in demand - if approvals are granted. Another manufacturing plant is also currently being built in the US and Novartis is actively looking to build strategic partnerships with contract manufacturers to significantly reduce the probability of similar disruptions occurring again.

But manufacturing is not the only challenge that Novartis will encounter in radiopharmaceuticals.

Novartis has a formidable opponent in the radioligand therapy space - Lantheus.

Lantheus may be a small company compared to Novartis - but it has big ambitions. It is gunning for the leadership position in the prostate cancer radioligand therapy space.

Interestingly, Lantheus is currently in a partnership with Novartis. The goal of the alliance is to test Pylarify, Lantheus’ PET imaging agent that is used to detect PSMA-positive tumors, to identify patients that can receive Pluvicto in trials. The relationship is obviously symbiotic since Pylarify will help patients get access to Pluvicto, and having Pluvicto approved in different prostate cancer indications will drive demand for Pylarify.

But Lantheus wants more than just imaging. A few weeks ago Lantheus made a deal with Point Biopharma for the rights to two of its assets. One of them, PNT2002, is a PSMA-targeting radiopharmaceutical therapy for metastatic castration-resistant prostate cancer that is currently in Phase III. Data will be presented at next year’s ESMO Congress in October. The structure of Lantheus’ deal with Point Biopharma is smart - but it does signal that Lantheus has concerns on whether PNT2002 will deliver or not.

Lantheus has been diversifying away from diagnostics and more into therapeutics -with now three products in the pipeline that could potentially challenge Pluvicto. While there might be some skepticism in terms of PNT2002, Novartis should be prepared to protect its turf.

DISCLAIMER: This is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

DISCLOSURE: I have no business relationships with any company that is mentioned in this article.

ABOUT ME: Clinician turned management consultant